The forex market revolves around a select few currencies that dominate global trading. Understanding these key players and their economic foundations can significantly enhance your trading strategy. Do not worry, because Bro In Finance is here to guide you with all the information you need as a trader to reach your targets.

1. US Dollar (USD)

The US Dollar is the reigning king of the forex market, with a daily trading volume exceeding $6.6 trillion globally. Its dominance is so profound that it features in all the major currency pairs. These pairs include the USD and one of the other leading currencies on this list, comprising roughly 85% of all forex trades.

Post-World War II, the US dollar solidified its role as the cornerstone of the global economy, as the US accounted for half of the world’s output. This led other nations to adopt the dollar for international transactions, avoiding conversion fees. Today, most of the world’s major commodity markets are priced in USD, maintaining the dollar’s preeminence.

Central banks around the globe hold the majority of their foreign exchange reserves in USD. These reserves, which include significant currencies like the Euro, British Pound, and Japanese Yen, help stabilize domestic currencies and facilitate international trade.

Popular USD Pairs: The USD/JPY pair, also known as “the gopher,” is one of the most popular pairs, accounting for 13.2% of all daily forex trades.

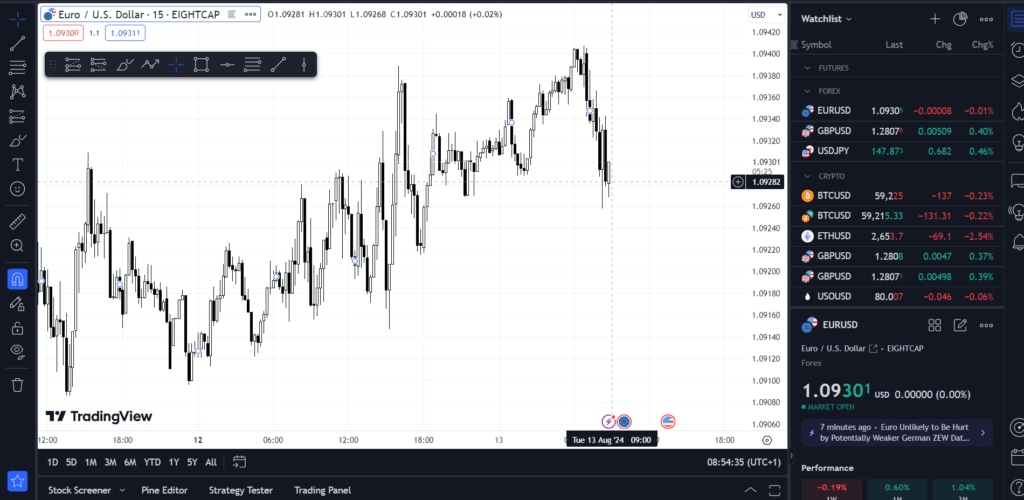

2. Euro (EUR)

The Euro holds the second spot in the forex market, with an average daily trading volume nearing $2.3 trillion. This currency is used by 19 EU member states and is governed by the European Central Bank (ECB).

Using the euro allows member states to bypass currency conversion fees, stimulating economic activity and driving GDP growth. However, the shared currency also means that economic issues in one country could affect the entire Eurozone.

Popular EUR Pairs: The EUR/USD pair is the most traded, as the US and European economies are among the most significant globally, making this pair a favorite among traders.

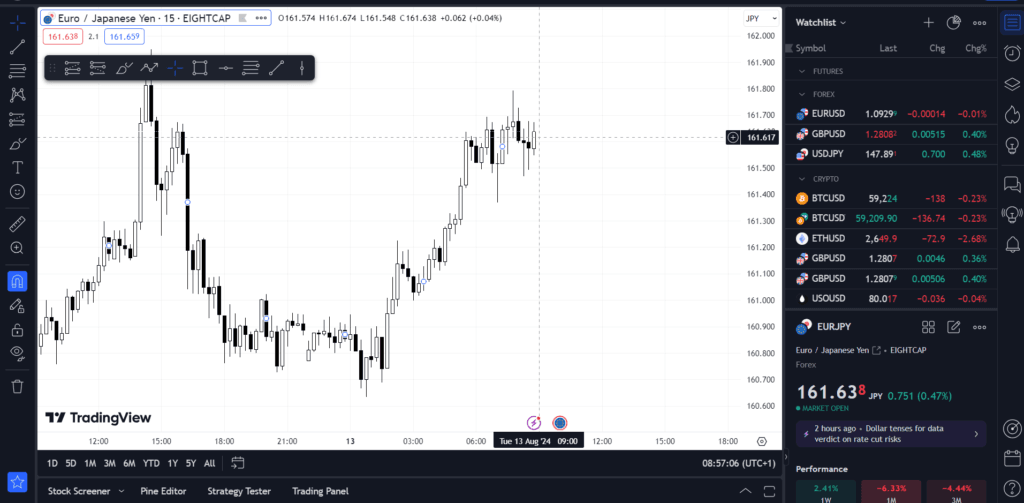

3. Japanese Yen (JPY)

The Japanese Yen is the third most traded currency, with an average daily trading volume of $1.2 trillion. Japan’s GDP ranks third globally, and its economy’s stability often attracts investors seeking a safe haven.

Known for its low inflation rate, the yen benefits from Japan’s aging population and subdued consumer demand. The Bank of Japan (BoJ) maintains ultra-low interest rates, sometimes even negative, which traders exploit using the carry trade strategy—borrowing yen to profit from interest rate differentials.

The BoJ closely manages forex trades to maintain the yen’s stability. Factors such as BoJ meetings, GDP reports, and industrial production data heavily influence the yen’s value. Japan’s economy also hinges on crude oil imports, making it vulnerable to geopolitical tensions in the Middle East.

Popular JPY Pairs: Traders of EUR/JPY pair monitor the trade dynamics between Japan and the Eurozone, along with key economic indicators.

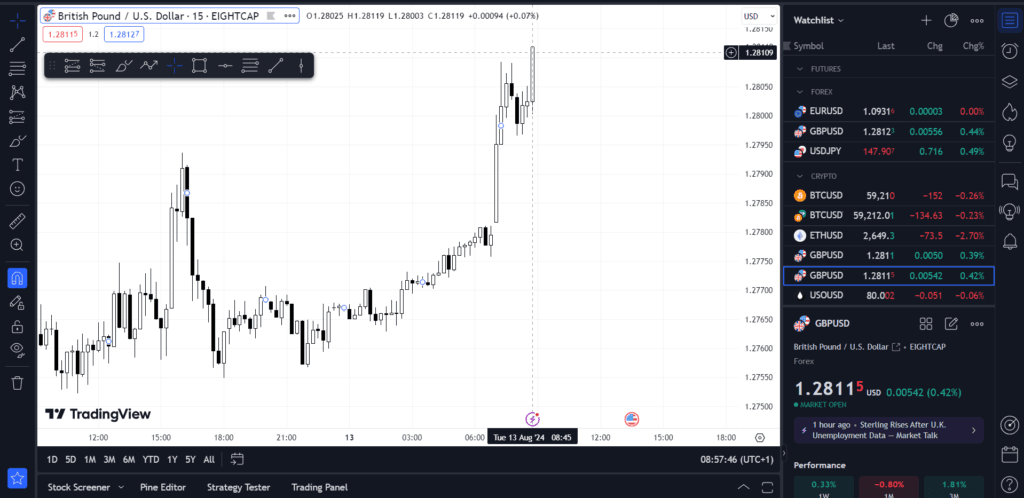

4. British Pound Sterling (GBP)

The British Pound Sterling is the official currency of the UK and its territories. With an average daily volume of around $422 billion, it is the fourth most traded currency worldwide and the fourth-largest reserve currency, holding 4.5% of global reserves.

The pound’s value is closely tied to the UK’s economic performance, including employment reports, GDP growth, inflation rates, and the Bank of England’s monetary policies.

Popular GBP Pairs: The GBP/USD pair, historically referred to as “cable,” remains the most traded. The nickname originates from the undersea cables that once connected London and New York, transmitting bids and quotes between these two financial hubs.

5. Australian Dollar (AUD)

The Australian Dollar ranks fifth in the forex market, with an average daily trading volume of $223 billion. It is managed by the Reserve Bank of Australia and holds 1.8% of the world’s reserves, making it the sixth most widely held reserve currency.

The AUD’s value is highly influenced by commodity prices and trade terms. Australia’s economy, reliant on the export of minerals like coal, iron, and copper, sees its currency fluctuate with global commodity demand.

Popular AUD Pairs: The AUD/USD pair, often called the “Aussie,” is directly impacted by Australia’s export performance.

By focusing on these major currencies, traders can navigate the forex market with greater confidence, leveraging the economic strength and stability that these currencies offer. Whether you’re trading the USD, EUR, JPY, GBP, or AUD, understanding the key factors that influence their movements will enhance your trading strategy and potential for success.

Stick with Bro In Finance to increase your knoweldge on these topics and as you embark on your trading journey, remember to stay informed, stay disciplined, and most importantly…..May the pips be with you!!!

Written by D Fernando