Hello traders! Welcome to today’s analysis of the USDCAD pair. Let’s dive into the recent market movements, key levels to watch, and some potential trading setups.

Recent Market Movements

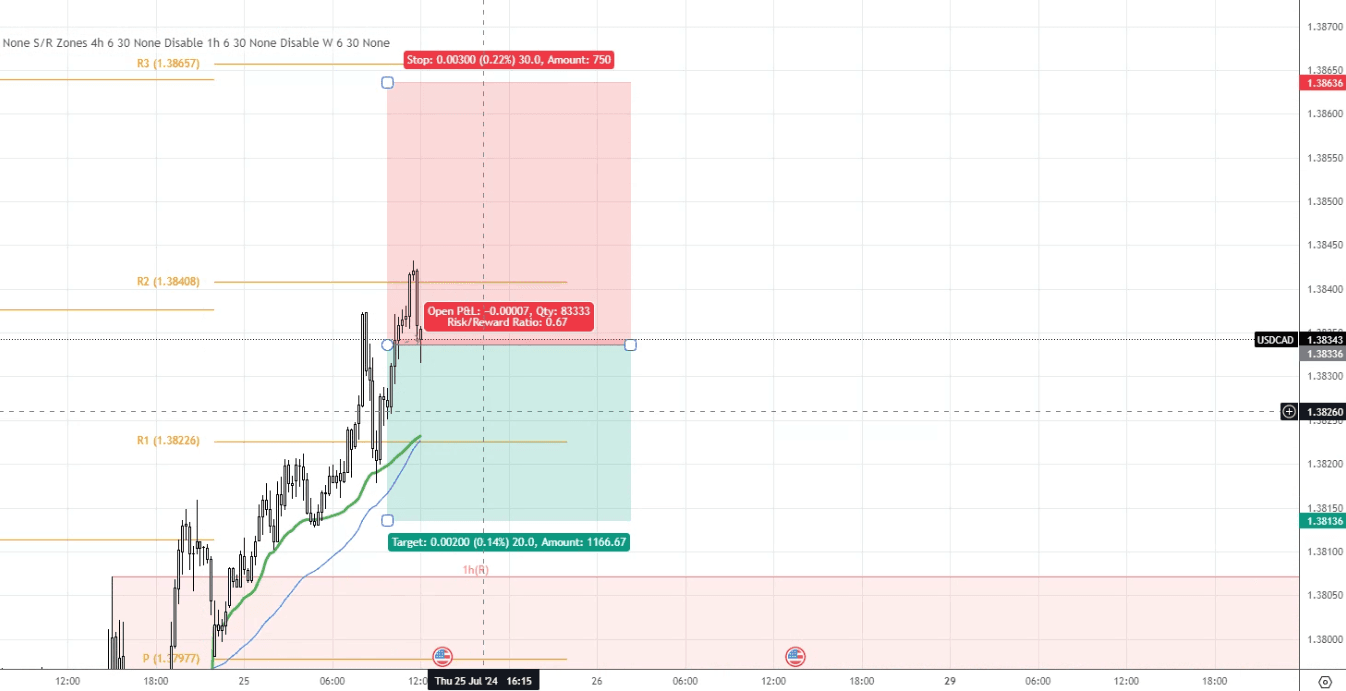

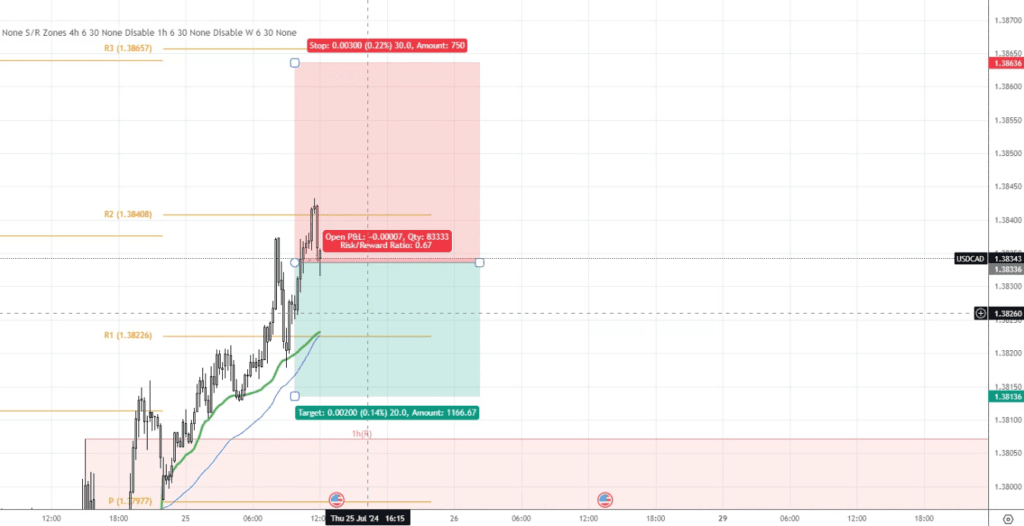

In the recent trading sessions, USDCAD has shown some fluctuations, reflecting a mix of bullish and bearish sentiments. The pair is currently trading around the 1.38336 level, and our analysis suggests that the market may experience a downward correction. According to our machine learning model, the mean value for today is calculated at 1.37950, which indicates a potential for bearish movement.

Key Levels to Watch

- Support Levels:

- 1.37795: This is the first support level where buyers might attempt to regain control if the price reaches this area.

- Resistance Levels:

- 1.38226: The first resistance level where sellers could step in to push the price lower.

- 1.38636: The second resistance level, also serving as our stop loss, which might challenge the downward movement if broken.

Entry, Exit, TP, and SL

Let’s get into a potential trading setup for the day. Given the current market conditions, here’s a trade idea:

Sell Setup:

- Entry Point: 1.38336

- Take Profit (TP): 1.38136

- Stop Loss (SL): 1.38636

Final Thoughts

We believe there is a favorable risk-reward ratio in the market right now. If you enter a sell trade at 1.38336, our machine learning model suggests a strong potential for a downward movement towards 1.38136. However, it’s important to monitor key economic data and market sentiment, as these can impact price movements.

Happy trading, and may the pips be with you!

Disclaimer: Trading in forex involves significant risk, and it’s essential to do your own research and consider your risk tolerance before making any trades. The analysis provided here is based on the Bro In Finance machine learning model and is intended for informational purposes only.

Article Written by D Fernando