Emerging markets have been out of favor for some time, but UBS says there could be some upside ahead given the U.S. election and the decline in potential growth drivers for the U.S. economy.

The three-year period of U.S. exceptionalism, with average nominal GDP growth of 8.3% versus China’s 5.6%, will soon end, according to UBS, with nominal growth set to fall below 4% next year.

This represents a lower bar for emerging markets, the bank adds. While growth in emerging markets is also likely to slow, growth differentials between emerging markets and the U.S. ex-China are rising to the ~90th percentile of their post-global financial crisis distribution.

“Every little bit helps an under-positioned asset class: Net portfolio inflows to emerging markets are experiencing their longest dry spell in 20 years,” UBS analysts said in an Oct. 15 note.

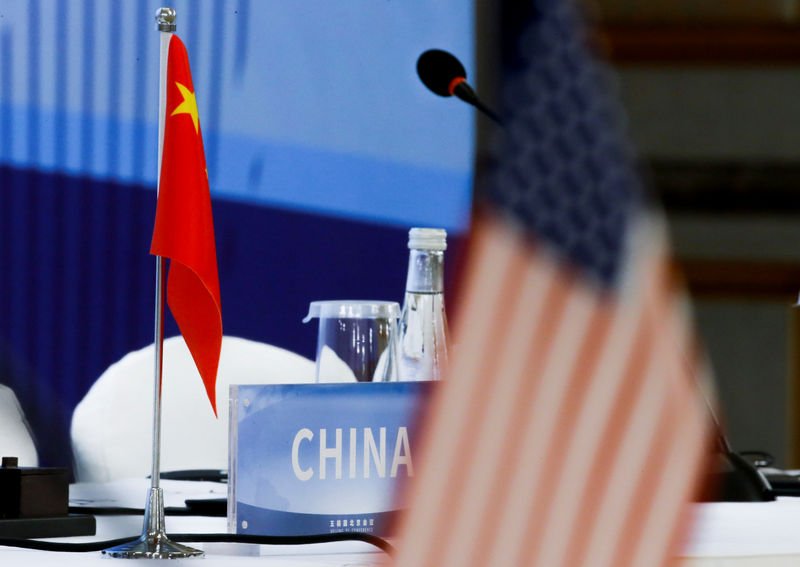

As for the upcoming US presidential election, barring the unlikely blue sweep scenario, UBS’s baseline scenario of a divided government next month with no additional tariffs is the most optimistic EM scenario for 2025.

Lower tariff fears, a weak US fiscal outlook and, despite all that, slowing growth lay the groundwork for a potential inflow rotation to emerging markets, the Swiss bank said, forecasting an MSCI EM score of 1255 by the end of 2025, representing a total return of ~10%.

All good so far, the bank added, but it also sees four obstacles to strong EM returns: weak(er) global trade – China’s housing will not bottom out until 2026, while US imports and Asia’s tech recovery are slowing; negligible EM risk premiums; the decline in US corporate bond yields is leveling off even after the Fed cut rates to 3.25%; and there is a risk of higher tariffs against China.

At Bro In Finance, we are committed to helping traders navigate the complexities of the forex market. Our in-depth analysis, expert insights, and advanced tools empower you to make informed decisions and achieve your trading goals. Whether you’re a beginner or an experienced trader, Bro In Finance is your trusted partner in mastering the forex market. Visit our website for more trading tips and strategies to enhance your trading experience.

Check out our on Best Forex Brokers to know more about this topic

Check out the most crucial steps that you need to take when choosing your forex broker

Have you heard about an amazing Broker Platform called “AVATRADE“? We at Bro In Finance do recommend this amazing broker.

Check out here to figure out the best funded trader program: Which Funded Challenge is Best

Reference;

Nurse, P. (2024) What will US elections and waning US exceptionalism mean for EM? UBS asks By Investing.com, Investing.com. Investing.com. Available at: https://www.investing.com/news/stock-market-news/what-will-us-elections-and-waning-us-exceptionalism-mean-for-em-ubs-asks-3663968 (Accessed: 19 October 2024).