The market is going into the final 2 trading days of 2024, and stocks are readied to publish an additional solid year of gains.

The Nasdaq Composite (^ IXIC) once more led the charge in 2024, increasing greater than 30% thus far while the S&P 500 (^ GSPC) has climbed over 25%. The Dow Jones Industrial Average (^ DJI) is up a more modest 14%.

A holiday-shortened trading week with restricted information on the docket is anticipated to greet investors in the final trading week of the year. Markets will be closed for New Year’s Day on Wednesday, and no major business are slated to report quarterly results.

In economic information, updates on housing prices and sales, along with a check out task in the production sector, are anticipated to highlight a suppressed week of launches.

Where’s Santa?

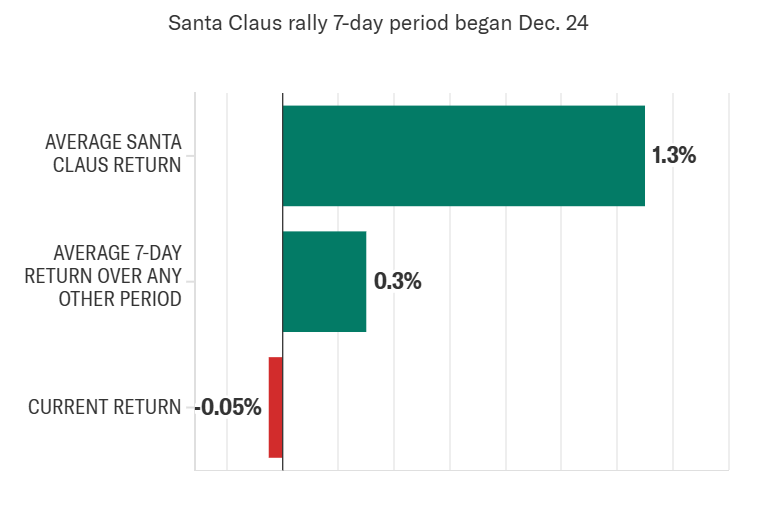

Markets are three days right into the very anticipated “Santa Claus” rally, which is statistically among one of the most constant seven-day favorable stretches of the year for the S&P 500.

Yet stocks have not been in the vacation spirit. All 3 major averages sold off Friday, with the Nasdaq falling almost 1.5%.

Because 1950, the S&P 500 has risen 1.3% during the seven trading days beginning Dec. 24, well above the normal seven-day average of 0.3%, according to LPL Financial chief technological strategist Adam Turnquist. Background has revealed that if Santa does come and the S&P 500 posts a favorable return during the time period, after that January is typically a favorable month for the benchmark index and the rest of the year averages a 10.4% return.

When the S&P 500 is adverse throughout that time structure, January generally doesn’t finish in the green, and the return for the upcoming full year averages just 5%, per Turnquist. 3 days right into this year’s Santa Claus period, which will close on Friday, Jan. 3, the S&P 500 is down less than 0.1%.

While history may be flashing an indication, it’s notable that in 2015 the Santa Claus rally really did not appear. January began badly too. Still, the S&P 500 is still readied to finish the year up greater than 20%.

SANTA USUALLY BRINGS PRESENTS TO THE MARKET

Rising rates.

As markets have digested the Federal Book’s recent message that interest rates might remain higher for longer than investors had really hoped, bond returns have actually been rising. The 10-year Treasury return (^ TNX) is up more than 40 basis points in December alone.

Hovering right over 4.6%, the 10-year goes to its highest degree in regarding 7 months and in the region where equity strategists think greater rates might start to weigh on stock efficiency.

” I assume 4.5% or higher on the 10-year obtains problematic for the markets more generally,” Piper Sandler chief financial investment planner Michael Kantrowitz said in a recent video sent to clients.

Kantrowitz further clarified in an interview, that any incoming economic data that sends out rates reduced could be a welcome sign for stocks.

” In the last couple of years, truly markets have only decreased because of climbing interest rate or rising cost of living worries,” Kantrowitz said on Dec. 18. “And I assume that’s the new normal that moving forward. Market modifications are going to come from greater prices, not slower development or higher joblessness.”.

10-YEAR TREASURY YIELD HOVERS NEAR 7-MONTH HIGH

All about principles.

Despite the current drawdown in markets considering that the Fed meeting on Dec. 18, the configuration heading into 2025 “has actually really not transformed,” Citi US equity strategist Scott Chronert wrote in a note to customers on Friday.

Stock appraisals stay high. Earnings are anticipated to grow concerning 15% year over year for the S&P 500, per FactSet information, creating a “high bar” to thrill investors. United States economic development is mostly anticipated to remain resilient.

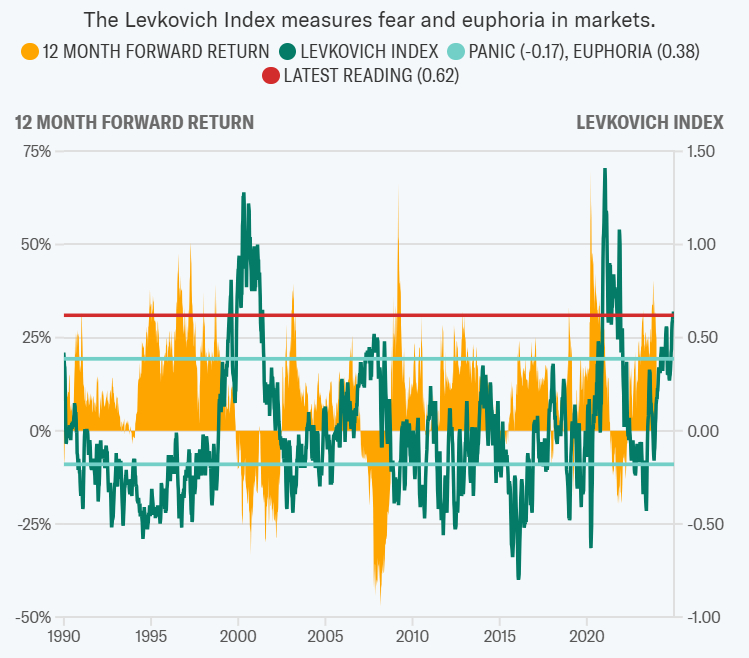

” In aggregate, investors appear bulled up on US equities,” Chronert created.

This has pressed market sentiment, as measured by Citi’s Levkovich Index, increasingly higher. The Levkovich Index, which thinks about investors’ short placements and leverage, among other variables, to identify market belief, currently rests at a reading of 0.62, above the euphoria line of 0.38, where the possibility of positive forward returns is usually lower as the market shows up stretched.

MARKET SENTIMENT REMAINS IN ‘EUPHORIA’

For now, this isn’t drinking Chronert’s overall confidence in the US equity market. He kept in mind that the “fundamentals” that have driven the market rally stay intact.

But strategists argue that extended view and evaluations do put the market rally on thinner ice ought to a stimulant that tests the bull thesis for 2025 arise.

” Generally, this configuration, plus the lack of real improvement in time, does leave the market extra at risk to enhancing bouts of volatility,” Chronert wrote. “If the fundamental tale holds, we would certainly be purchasers of first fifty percent pullbacks in the S&P 500.”.