Gemini, a leading cryptocurrency exchange, has introduced its electronic over-the-counter (eOTC) trading platform, specifically designed for institutional investors. The new platform provides automated, efficient trading with features tailored for large-scale transactions. This development is significant in the rapidly growing crypto market, as it addresses institutional demand for secure, regulated, and reliable trading solutions. Here’s a closer look at the key benefits and importance of Gemini’s eOTC solution for institutional traders.

Benefits of Gemini’s eOTC Platform

- Competitive Pricing and Instant Execution

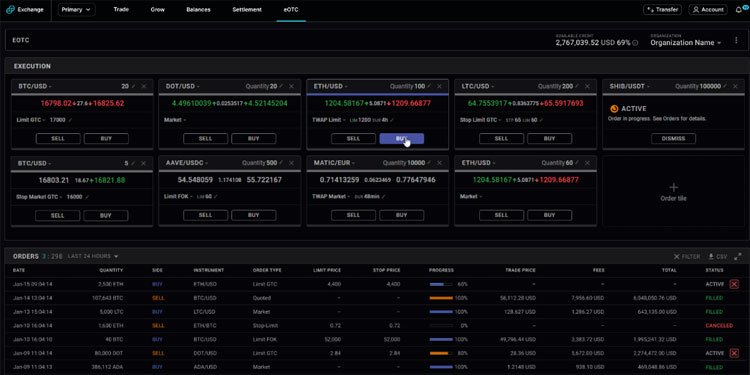

Gemini eOTC connects institutional investors with top-tier liquidity providers, ensuring access to deep liquidity pools. This connectivity enables competitive pricing, allowing trades to execute rapidly and efficiently at the best market prices. The minimum trade size of $1,000 notional value ensures accessibility for a range of institutions, optimizing order fulfillment with minimal transaction fees. - Customizable, Intuitive Interface

eOTC offers an interface that allows users to personalize their trading experience, providing real-time price updates on the assets they are most interested in. This customization ensures traders can monitor and respond to market movements instantly, enhancing their ability to execute strategic trades without delay. - Delayed Settlement for Capital Efficiency

Gemini eOTC integrates seamlessly with Gemini Settlement, allowing delayed settlement at a predetermined time. This feature is crucial for capital efficiency, as it eliminates the need for pre-funding and allows traders to make the most of trading opportunities without the risk of missing out due to capital restrictions. Through intra-day settlement, users can manage capital more effectively and reduce liquidity constraints. - Regulatory Compliance and Security

Operating under New York State law and licensed by the New York State Department of Financial Services (NYDFS), Gemini eOTC upholds high regulatory standards. Additionally, the platform’s SOC 2 Type II compliance ensures that it adheres to strict protocols for security and data integrity. These regulatory assurances provide institutional investors with the confidence that their trades are conducted within a secure, transparent, and compliant environment.

Why Gemini eOTC Matters for Institutional Investors

The introduction of Gemini’s eOTC platform is timely, as institutional interest in cryptocurrency markets continues to grow. Institutions often face barriers in crypto trading, such as limited liquidity, regulatory uncertainties, and inefficient settlement processes. Gemini eOTC addresses these challenges, offering a seamless trading experience with competitive pricing, high regulatory compliance, and capital efficiency—all essential elements for institutions managing large trading volumes.

With its robust infrastructure and focus on compliance, Gemini’s eOTC solution serves as a trusted bridge between traditional finance and the evolving crypto ecosystem, making it an attractive choice for institutions looking to participate in digital asset markets while ensuring regulatory and security standards.

Conclusion

Gemini’s eOTC platform sets a new standard in institutional crypto trading by delivering a secure, efficient, and regulated environment. The platform’s advanced features cater directly to the needs of institutional investors, allowing them to trade with confidence and agility. As Gemini continues to expand its services across 70 jurisdictions, its eOTC offering highlights the exchange’s commitment to fostering a secure and accessible marketplace for institutional participants globally. For more information on using Gemini eOTC, visit their FAQ page.

Reference;

CryptoNinjas.net (2023) Crypto exchange Gemini launches new electronic OTC trading solution, CryptoNinjas. Available at: https://www.cryptoninjas.net/2023/01/19/gemini-launches-institutional-electronic-over-the-counter-trading/ (Accessed: 28 October 2024).

Download iOS App

Download iOS App

Download Google Play

Download Google Play