Hello traders! Welcome to today’s analysis of the GBP/USD pair. Let’s dive into the recent market movements, key levels to watch, and some potential trading setups.

Recent Market Movements

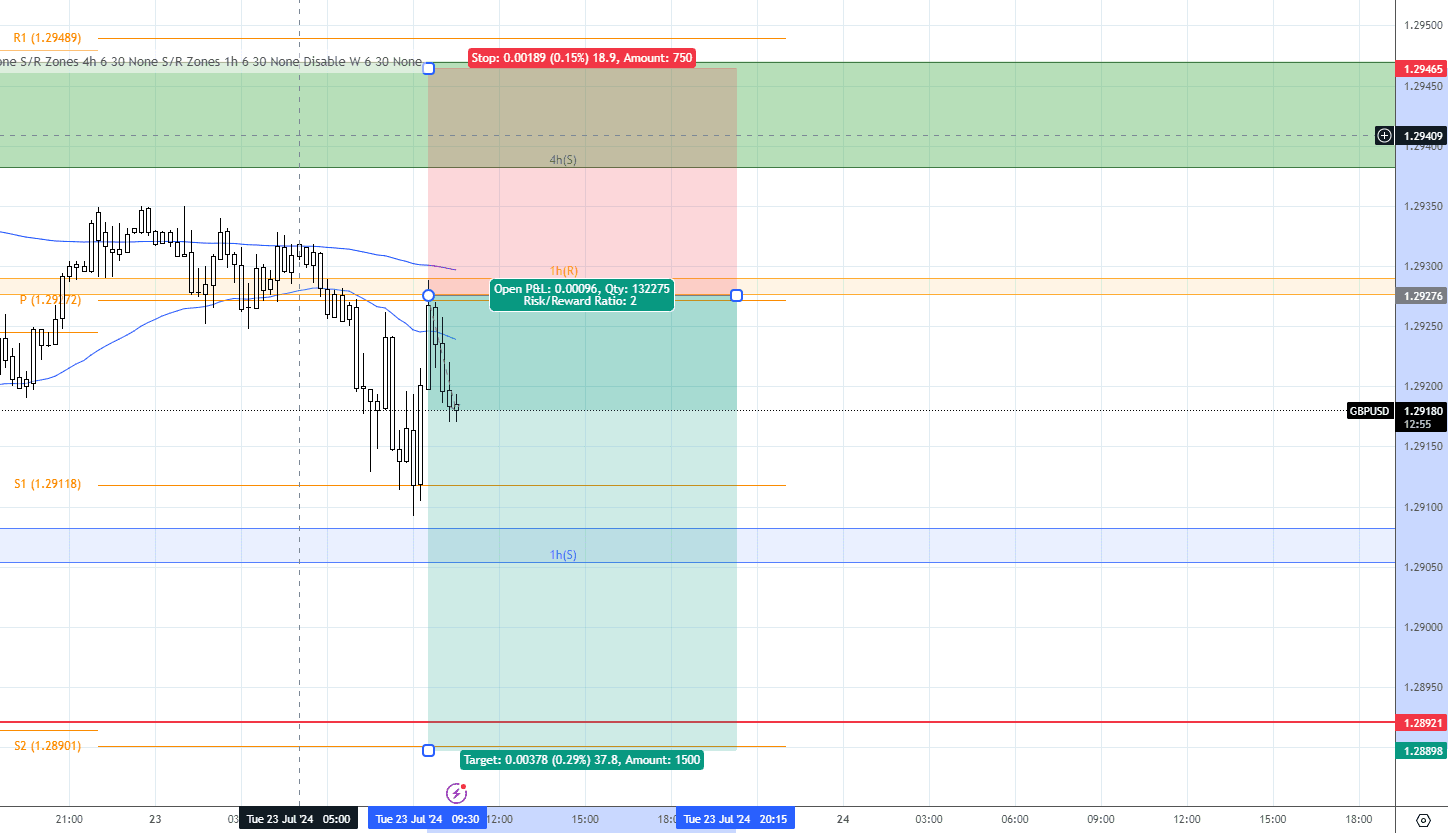

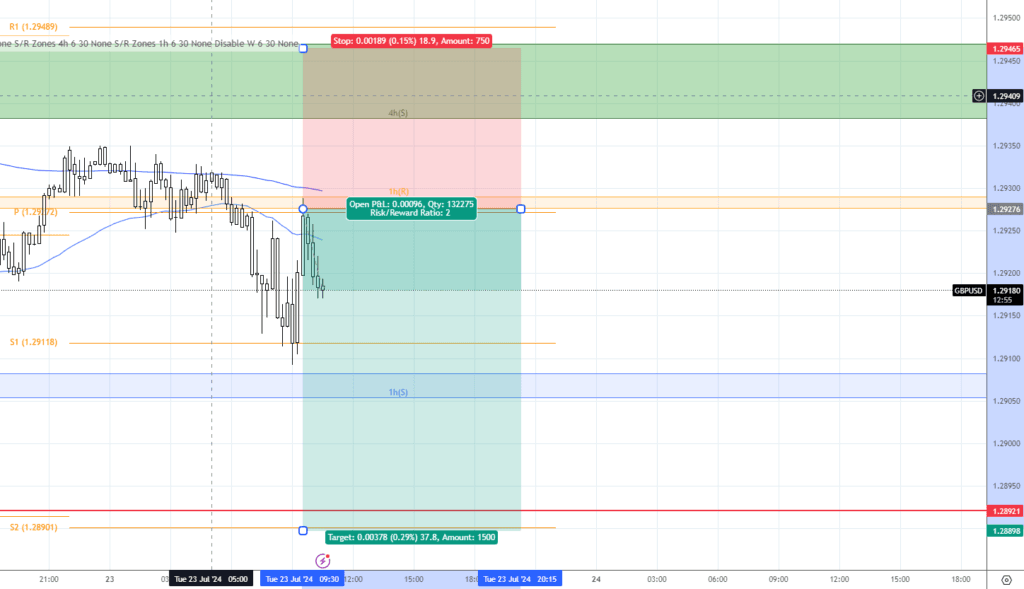

The GBP/USD pair has shown some interesting movements over the past 24 hours. We observed a notable drop followed by some consolidation. The pair is currently trading around the 1.29272 level, reflecting a cautious market sentiment.

Key Levels to Watch

Support Levels:

- 1.29272: The pivot point (P) from the chart, providing immediate support.

- 1.29118: A stronger support level (S1) that has held previously and may attract buyers if the price drops to this region.

Resistance Levels:

- 1.29382: The first resistance level (R1) that might challenge the upward movement.

- 1.29489: A potential secondary resistance level where sellers could step in if the price moves higher.

Entry, Exit, TP, and SL

Let’s get into a potential trading setup for the day. Given the current market conditions, here’s a trade idea:

According to our machine learning model, the market is showing mixed signals, but there seems to be a potential for a short-term downtrend continuation.

Sell Setup:

- Entry Point: 1.29276

- Take Profit (TP): 1.28898

- Stop Loss (SL): 1.29465

Final Thoughts

We believe there is a 1:2 reward ratio in the market right now. If you are able to enter a trade at 1.29276, our analysis suggests a strong potential for a short signal. We are not expecting any surprising data from UK and US economic news, so it is relatively safe to enter the market after the UK market opens up at 7.00am GMT+1 with a pending order.

Happy trading, and may the pips be with you!

Remember, trading in forex involves significant risk, and it’s essential to do your own research and consider your risk tolerance before making any trades.

Article Written by L Ranepura