Hello traders! Welcome to today’s analysis of the GBP/USD pair. Let’s dive into the recent market movements, key levels to watch, and some potential trading setups.

Recent Market Movements

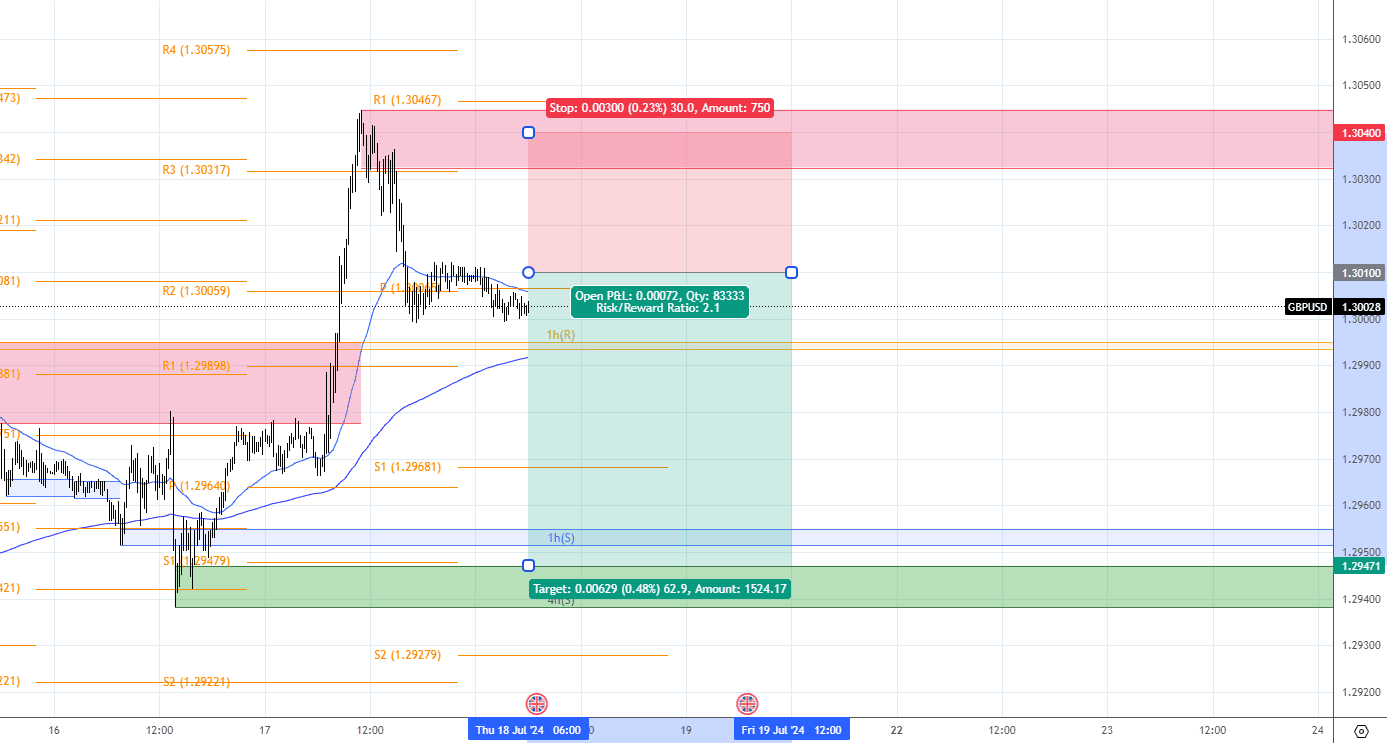

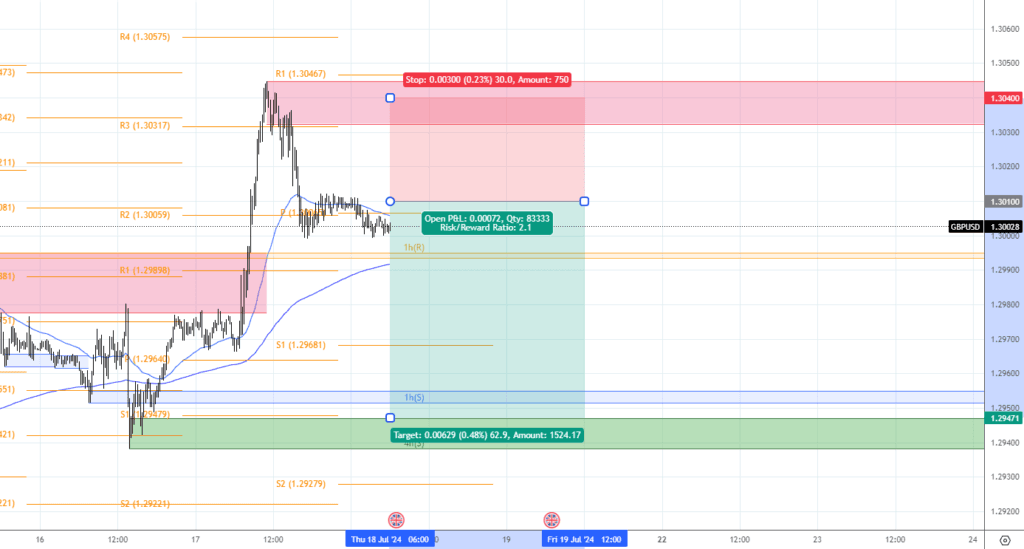

The GBP/USD pair has shown some interesting movements over the past 24 hours. Yesterday, we saw the GBPUSD hitting the one year high at 1.30450, we believe this is the peak and the momentum is with the seller.

Key Levels to Watch

Support Levels:

- 1.3050: This level has acted as a strong support in the past and is likely to hold unless there’s significant news affecting the pound or dollar.

- 1.3000: A psychological level that could provide substantial support if the price breaks below 1.3050.

Resistance Levels:

- 1.3045: The recent high and a key resistance level. A break above this could signal a further upward movement.

- 1.3150: Another psychological level that could attract sellers if the price reaches this point.

Entry, Exit, TP, and SL

Let’s get into a potential trading setup for the day. Given the current market conditions, here’s a trade idea:

According to our machine learning model, the market is in a downtrend and it is indicating the price is going to break the 1.3000 level to 1.29018 level.

This setup should be trade should open within 6.00am to 11.00am GMT +1

Sell Setup:

- Entry Point: 1.30100

- Take Profit (TP): 1.29470

- Stop Loss (SL): 1.30400

Market Sentiment and Economic Indicators

Market sentiment appears mixed, with traders closely watching economic indicators from both the UK, EU and the US. Key data to watch today include:

- Unemployment Rate: Forecast rate of 4.4%

- ECB Interest Rate Decision: Forecast Rate of 4.25%

Final Thoughts

We believe, there a 1: 2 reward ratio in the market right now, if you are able to enter a trade at 1.30100, all our machine learning models are providing a strong short signal. We are expecting no surprise data from UK and EU economic news, so it is safe to enter to the market when the UK market opens up at 7.00am GMT +1 with a pending order.

Happy trading, and may the pips be with you!

Remember, trading in forex involves significant risk, and it’s essential to do your own research and consider your risk tolerance before making any trades.

Article Written by L Ranepura