Bro in Finance proprietary AI prediction model yet again predicted that UK-listed packaging giant Mondi plc (MNDI.L) to reach 1600 GBX by the June of 2026 which is a good news for the long terms investors from the current level of 1267.5 GBX with a expected return of 26.23% return on investment. Mondi plc currently offer about 4.72% dividend yield at the current share price.

If we look very closely who owns the majority shares of Mondi plc, its of course the institutional investors which is about 70% yikes!!. Our AI model has analysed stock data and financial performance of the Mondi plc when predicting the future which has RMSE error of 74.4 our model expect the EPS per share to rise in the next year to 0.93. While keeping retaining the PE ratio at the current level of 17.13.

Here are some of the key information about Mondi plc (MNDI.L)

Fundamental development that supported our analysis of Mondi Plc

Mondi to get Western Europe Product packaging Possessions of Schumacher Packaging

Key takeaways

- Strengthens Mondi’s corrugated transforming footprint in Europe with extremely corresponding possessions, enhancing capacity by over 1 billion square meters

- Offers synergies with the Group’s noticeable European containerboard business.

- Includes two cutting edge mega-box plants in Germany, located at Ebersdorf and Greven, protecting substantial capability to satisfy the expanding demand for sustainable product packaging

- The overall worth of the business is EUR634 million, which will certainly be spent for utilizing existing economic. Earnings per share are anticipated to year after the deal is wrapped up.

Mondi plc (“Mondi” or the “Group”), a global leader in the production of sustainable packaging and paper, today announces that it has actually entered into an arrangement to obtain the German, Benelux and UK corrugated converting and solid board procedures of Schumacher Packaging (“the Procurement”). This Purchase will certainly broaden Mondi’s corrugated footprint in Western Europe and include complementary fibre-based products, concentrated on eCommerce and FMCG, to boost its existing consumer offering.

Today’s statement is in line with Mondi’s approach to expand its Corrugated Packaging business in Europe and surrounding markets; to invest in cost advantaged assets; to additionally integrate upstream and downstream procedures to make sure security of supply for customers and optimised procedures, and to continue to companion with clients to provide cutting-edge remedies.

The acquisition includes a collection of seven corrugated product packaging sites, two facilities that manufacture strong board, and four facilities that process strong board. This acquisition enhances Mondi’s current corrugated packaging network in Central and Eastern Europe, increasing capacity by more than 1 billion square meters once fully operational. Especially, the gotten assets consist of two sophisticated mega-box facilities in Germany, located in Ebersdorf and Greven, which boast remarkable manufacturing rates, functional efficiency, and a very knowledgeable labor force that shares Mondi’s worths and society.

Expanding Mondi’s eCommerce offering-particularly in Germany, the largest packaging market in Europe-presents considerable possibilities to introduce the Team’s special variety of items to a broader range of consumers as they significantly transition towards even more lasting product packaging services.

Schumacher Product Packaging’s Western European operations reported an adjusted EBITDA of EUR66 million in 2023. The company expects this figure to increase with the launch of its new Greven facility, which is the result of a significant investment initiative, and the realization of EUR22 million in cost savings over the next three years. This projection does not consist of approximated one-time cash money expenses of around EUR18 million needed to accomplish these outcomes.

Andrew King, Mondi Team Chief Executive Officer, Shares Words on Procurement

“We’re that accommodate the rising need for green packaging services, while delivering go back to our stakeholders. This procurement improves our production capabilities for corrugated products, broadens our existence in Western Europe, and unlocks opportunities for boosted supply chain integration, ultimately enhancing complementary series of fibre-based items that benefit our clients.”

We are thrilled regarding getting these possessions and aspire to invite our brand-new Schumacher Product packaging group and customers to the Mondi family. When the process is completed, Mondi will have a more powerful offering for consumers and a solid structure for future expansion.

Finally! It’s a strong “BUY” from Bro in Finance

Given Mondi’s substantial growth potential in the packaging industry with the acquisition of Schumacher packaging to be finalised by the first half of the 2025 and the decision to keep Mr Bjoern Schumacher and Mr Hendrik Schumacher, respectively, as a tactical adviser and as Chief Operating Police Officer Solid Board is a very strategic decision in our opinion. We believe that our 1,600 GBX target with a return of 26% by 2026 is a good buying opportunity for a long term investor with a potential an annual dividend of 4.72%.

For more US Finance News at Bro in Finance US Finance News

For more US AI Stock Analysis at Bro in Finance US AI Stock Analysis

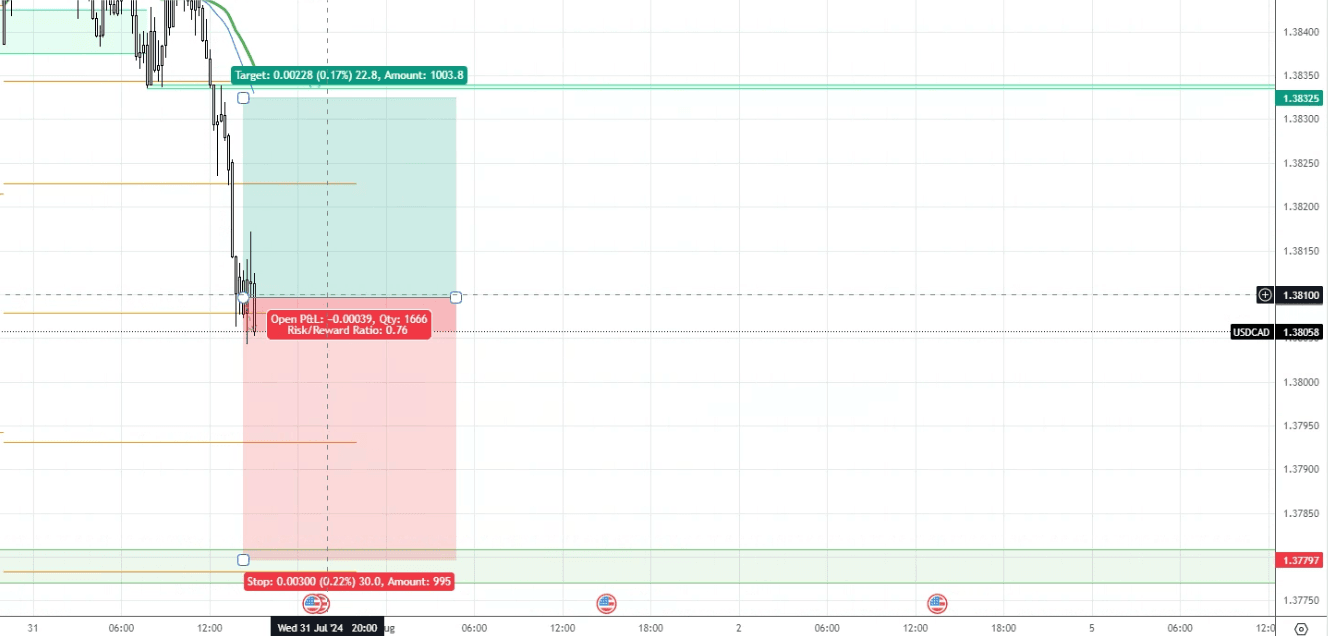

For AI driven forex predictions at Bro in Finance

For Crypto News at Bro in Finance

For Economic Calendar for at Bro in Finance

Crypto, Simplified. Buy Now with Bro In Finance.

To Trade up to million dollars with Best Prop firms in the industry

If you are looking for a Best forex broker that Bro in Finance recommend AvaTrade

Check out Our Free ” How to” guides at Bro in Finance

Disclaimer: Stock trading carries significant risk and may not be suitable for all investors. This analysis, based on Bro In Finance’s proprietary data, is provided for informational purposes and should not be considered investment advice.