Hello traders! Welcome to today’s analysis of the USDCAD pair. Let’s dive into the recent market movements, key levels to watch, and some potential trading setups.

Recent Market Movements

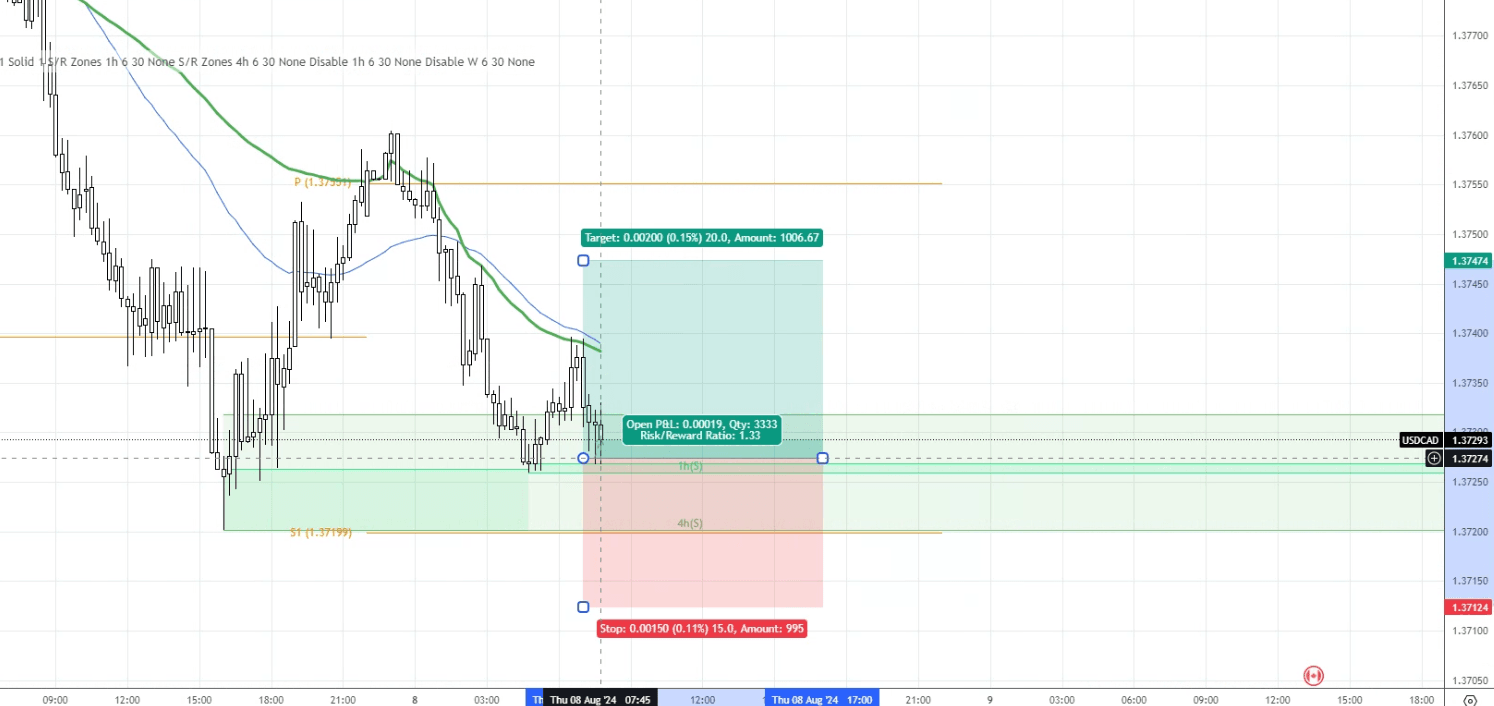

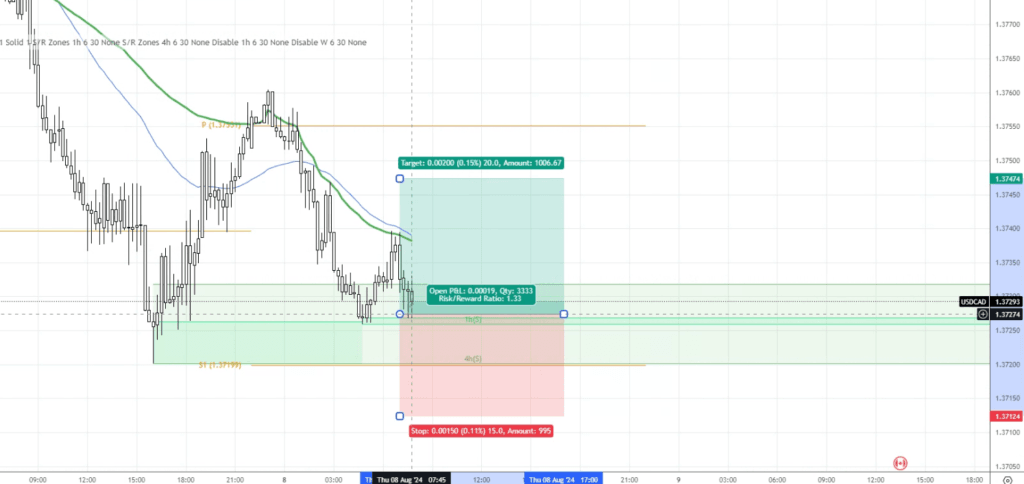

The USDCAD pair has been showing gradual strength, with the market pushing upwards after some consolidation. The pair is currently trading around the 1.37274 level. Our machine learning model has generated a mean value of 1.37487 for today, indicating potential upward momentum.

Key Levels to Watch

- Support Levels:

- 1.37709: A crucial support level that could provide a strong base if the price retraces before heading higher.

- Resistance Levels:

- 1.38585: The Pivot Point for the day, which might act as a barrier to further gains.

- 1.39081: A significant resistance level to watch for potential reversals or breakouts.

Entry, Exit, TP, and SL

Let’s consider a potential trading setup for the day. Based on our analysis and machine learning model, here’s a trade idea:

Today’s Mean Value – 1.37487

Buy Setup:

- Entry Point: 1.37274

- Take Profit (TP): 1.37474

- Stop Loss (SL): 1.37124

This setup offers a 1:1.33 risk-to-reward ratio, which aligns with our risk management strategy.

Final Thoughts

Today’s setup is designed to capitalize on a moderate upward movement, with a well-defined risk-to-reward ratio. If the market conditions remain stable, entering at 1.37274 could lead to a successful trade towards the 1.37474 target. As always, be mindful of any economic news or events that could impact the trade.

Happy trading, and may the pips be with you!

Disclaimer: Trading in forex involves significant risk, and it’s essential to do your own research and consider your risk tolerance before making any trades. The analysis provided here is based on the Bro In Finance machine learning model and is intended for informational purposes only.

Article Written by D Fernando