UK Inflation

The consumer price index due on Wednesday rose a yearly 2.2%. That’s up from 1.7% last month, when it slipped below the BOE’s 2% target for the first time in more than three years.

While the heading gauge is seen speeding up as a result of greater energy prices, underlying measures consisting of services inflation are likely to have actually deteriorated somewhat.

The total image– of slowly moderating however still-excessive cost growth– may support the BOE’s steady strategy towards financial relieving until now.

Officials supplied a 2nd quarter-point rate cut in November and stayed clear of sending any signal that much faster alleviating might be needed. The stance is a lot more restrained than that of the bordering euro zone, and chimes with the calm tone embraced in the past week by US Federal Reserve chief Jerome Powell.

What Business economics Claims:

” Services inflation is likely to alleviate progressively from here, supporting the instance for the BOE moving slowly. We believe it will certainly hold prices steady in December before reducing at a quarterly rate in 2025.”

BOE Governor Andrew Bailey will be grilled on UK inflation and monetary policy when he shows up before legislators on the eve of the information release. Concerns may focus on the financial impact of the Work federal government’s current budget plan, and Friday’s information that growth cooled more than anticipated in the 3rd quarter.

Along with Bailey will be colleagues including Alan Taylor, making his very first public statements as a rate-setter because signing up with the plan board in September. Speaking later in the week are Deputy Governor Dave Ramsden and Catherine Mann, the sole citizen that desired no change in borrowing prices this month.

A peek into the wellness of the UK consumer will show up on Friday, when retail sales information for October are released. Economic experts expect the numbers showing the initial decline in 4 months. Getting supervisor surveys appear the same day.

In other places, wage numbers in the euro area, inflation in Canada, and rate choices from Indonesia to South Africa will be amongst the highlights.

United States and Canada

The US economic information schedule brightens up in the coming week, with fresh reads on the real estate market taking prominence. On Tuesday, a federal government report is forecasted to reveal housing starts in October declined for the 3rd time in 4 months as home builders concentrate on lowering inventory.

National Organization of Realtors data on Thursday are forecast to reveal October contract closings on previously-owned homes increased as a decrease in home mortgage prices the prior month helped stimulate demand. On Friday, the University of Michigan will release its last November customer sentiment index, consisting of actions in the wake of the presidential election.

Lisa Cook, Jeff Schmid, Austan Goolsbee and Beth Hammack are amongst Fed officials with scheduled events.

Data Canada will release consumer-price information for October, and early price quotes suggest inflation might have stayed listed below the Financial institution of Canada’s 2% target. The data may help resolve an argument over whether officials must reduce loaning expenses by 25 or 50 basis factors next month.

Asia

Lenders in China, in accordance with guidance from the People’s Bank of China, are expected to hold funding prime rates constant after making larger-than-expected cuts last month, leaving the 1-year and 5-year rates at 3.1% and 3.6%, specifically.

Elsewhere, Indonesia’s reserve bank may trim its benchmark price on Wednesday by a quarter-point, to 5.75%, after customer inflation relieved to the slowest pace in three years.

Financial Institution of Japan Governor Kazuo Ueda will talk at an annual occasion on Monday that makes sure to draw in close examination for any tips on the timing of the central bank’s following rate walk. At the end of the week, Japan is expected to report that consumer inflation relieved a bit in October, to 2.2%– a result that would expand the streak of months at or above the BOJ’s target to 31 months.

The Reserve Bank of Australia releases mins from its November meeting on Tuesday, and Guv Michele Bullock talks on Thursday. Australia, Japan and India all obtain PMI statistics for November on Friday.

Malaysia and Hong Kong additionally report consumer rate development in the week ahead.

Thailand’s economic growth held basically constant in the third quarter, information Monday may reveal, while trade numbers are due throughout the week from Malaysia, Japan, Singapore, South Korea and Taiwan.

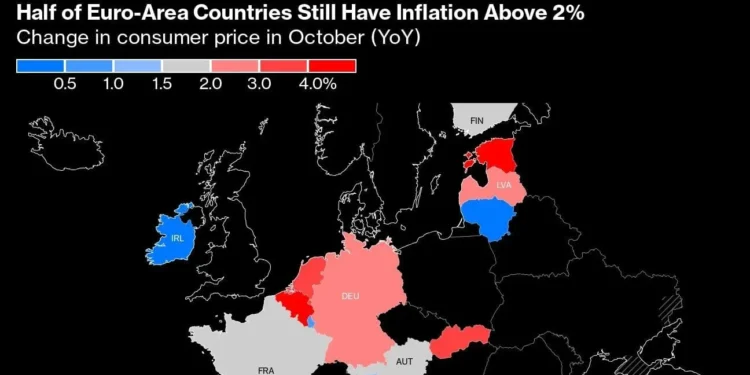

Europe, Center East, Africa

A chaotic week remains in shop for financiers tracking the European Reserve bank. Multiple appearances by policymakers are scheduled, including 2 by President Christine Lagarde. In all, more than half of the Governing Council will talk.

The ECB will certainly likewise release its quarterly wage indication on Wednesday– a crucial metric for authorities determining pipe price stress– and after that its most current assessment of euro-zone monetary dangers the following day.

Among data releases, the final measure of inflation for October on Tuesday, customer self-confidence on Thursday, and after that buying manager studies the list below day might be highlights.

Moody’s Ratings is set up to disclose a prospective update on Italy at the end of the week, its initial considering that the country introduced strategies to get its deficit listed below the European Union’s 3% ceiling by 2026.

Turning to the Nordics, Denmark will certainly release gross domestic product numbers on Wednesday, with Norway doing so a day later on. And in Switzerland, policymaker Petra Tschudin and Swiss National Bank principal Martin Schlegel are set up to talk toward completion of the week.

Latin America

Colombian data out Monday should highlight some of the weak point at the margins of the economic climate, even as July-September result numbers reveal a pickup from the previous 3 months.

In Chile, third-quarter GDP numbers are likely to reveal a rebound from an April-June slump, though month-to-month GDP-proxy analyses suggest the economy is shedding energy.

Solid second-quarter growth seen in Peru may extend well right into the second half. Third-quarter result information will likely reveal energy holding steady near the 3.6% annual rate of the 3 months with June.

The agreement among financial experts is that Argentina’s economic downturn will certainly start to ease in the fourth quarter after a deep July-September downturn, though the September economic task analysis will likely be available in over August’s -3.8% outcome.

The week end up with a rather complete photo of Mexico, Latin America’s second-biggest economic situation. Mid-month customer price data may highlight why Banxico increased its fourth-quarter inflation quote to 4.7% from 4.3%.

Retail sales in September may have risen for a third month, while the last third-quarter outcome report will reaffirm that Mexico’s economy rebounded on resistant residential demand and trade with the US, its No. 1 profession partner.

For more US Finance News at Bro in Finance US Finance News

For more US AI Stock Analysis at Bro in Finance US AI Stock Analysis

For AI driven forex predictions at Bro in Finance

For Crypto News at Bro in Finance

For Economic Calendar for at Bro in Finance

Crypto, Simplified. Buy Now with Bro In Finance.

To Trade up to million dollars with Best Prop firms in the industry

If you are looking for a Best forex broker that Bro in Finance recommend AvaTrade

Check out Our Free ” How to” guides at Bro in Finance