As many of us have seen the Jake Paul vs Mike Tyson Boxing match the winner was Jake Paul as many anticipated. Jake Paul won quite easily. As we all know Jake Paul came to boxing very recently through his fame on Social Media while Mike Tyson was a career boxer.

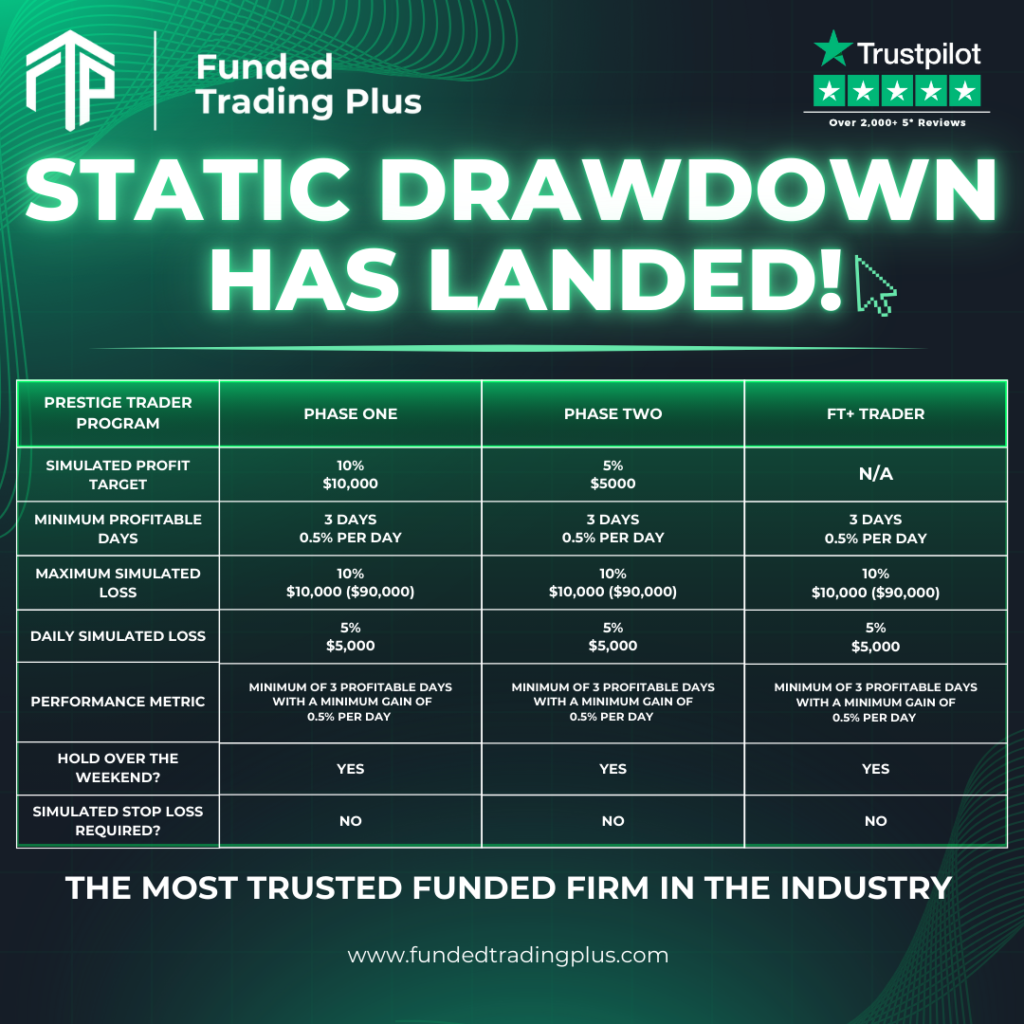

The Story of FTMO and Funded Trading Plus (FTP) is somewhat similar because, during the past couple of years, the difference between the FTMO and FTP was that the static drawdown account type

(The Prestige Trader Program) of FTMO was not offered by FTP.

For those who don’t know what static account type means: It means no matter the profit you make the drawdown is fixed from the starting balance. This means if you were to get a $100,000 account the max loss limit would be 10% of the initial balance meaning $90,000. Imagine if you were to make

$10,000 in profit you would have a drawdown limit of 20% meaning still at $90,000 just imagine the possibilities.

Here is how the Program is structured: It is a Two-Phase Evaluation model with Static Drawdown which is called

“The Prestige Trader Program“

Phase 01 – Assessment 01

- Profit Target: 10%

- Max Loss Limit: 10%

- Max Daily Loss: 5%

Phase 02 – Assessment 02

- Profit Target: 5%

- Max Loss Limit: 10%

- Max Daily Loss: 5%

The $100,000 Prestige Trader Program (Static Drawdown) now starts at $499 at FTP

Note all of these programs consist of performance metrics: You need to have at least 3 days with a minimum gain of 0.5%. In context: if you have bought a $100,000 account you need to have $500 profit for three days, which doesn’t have to be consecutive.

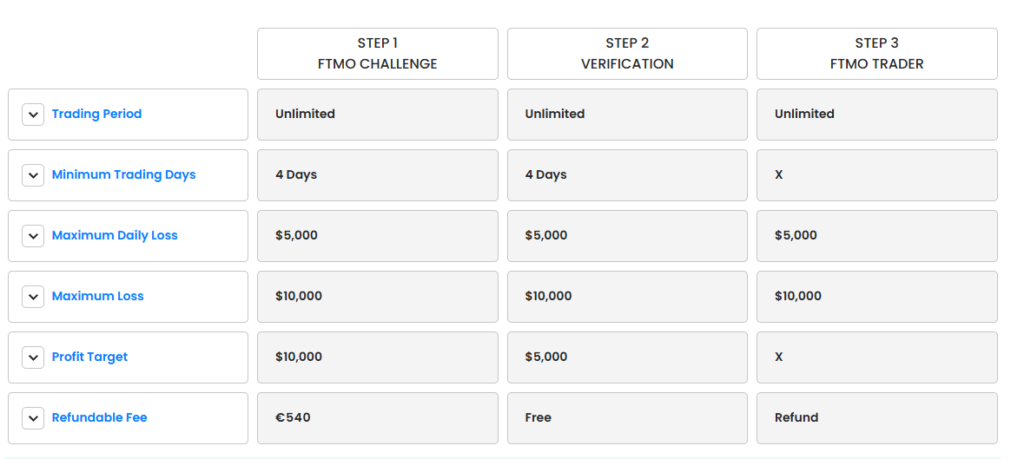

Now let us compare FTMO Vs FTP

As many of us heard of Mike Tyson, FTMO is in a similar position at this juncture, They had to offer unlimited time because FTP forced the market to let traders have their freedom to trade rather than limit them to trade within 30-60 days to reach their target.

If we compare the offerings of FTMO and Funded Trading Plus, they both offer very similar targets for phases one and two. The first difference is that at FTP you are required to show them you are performing which is a requirement by a genuine prop firm that funds their prop firm, traders, it is not sensible for a company to give you capital and set you rotten their capital when they can allocate capital for best-performing traders!. You have to think about their motive behind giving us the capital, they also need to make a profit, it’s not a retail business it is a Prop firm that runs like a hedge fund!

The $100,000 Prestige Trader Program (Static Drawdown) now starts at $499 at FTP

Here is the Review of the Funded Trading Plus (FTP) which includes Ownership, Financial and Reviews Analysis

Ownership Analysis

Funded Trading Plus (FTP) is formally registered as FTP London Ltd, with a business number of 13719292, and is classified under the business code 82990, which incorporates various service support services. Because of its incorporation on November 2nd, 2022, several significant modifications on November 14th, 2023. These updates include the addition of individuals with significant control, as well as the removal of James Anthony Frangleton, Michael Christopher Cogswell, and Simon Paul Massey from this function, all of which occurred on February 17th, 2023. This level of activity, as tape-recorded on the UK’s company information service, recommends that the business actively take part in fundraising efforts.

In addition, the CMF Assets Limited Registration number 14496792, Correspondence address Bell Yard, London, England, WC2A 2JR. The Cmf Assets Limited now control more than 75% of the voting rights and owns more than 75% of shares.

Source: Person with significant control

Two officers are working at FTP London Ltd,

Director Of Operations: FRANGLETON, James Anthony

Managing Director: MASSEY, Simon Paul

We can award them 9/10 for the Ownership structure since it’s well-documented and highly transparent. The deduction of one point is due to the transfer of ownership of FTP London to a private limited entity.

Financial analysis of Funded Trading Plus (FTP London Ltd)

- On the 2nd of November 2021, the company was formed with a stated capital of £3.

- The First Unaudited abridged account was filled on 26th July 2022

Here is the summary of the Unaudited Financial Statements of FTP London LTD

Period of Accounts: 02 November 2021 till 30 November 2022

Highlights of the Balance Sheet

- Total Current Assets: £3,833,175

- Total Net Assets: £2,532,097

- Shareholders funds: £2,532,097

Period of Accounts: 01 December 2022 till 30 November 2023

- Total Current Assets: £8,668,500

- Total Net Assets: £4,516,712

- Shareholders funds: £4,516,712

Here is the Financial Analysis of FTP London Ltd

Based on our analysis, they have founded the company with a GBP 3, it’s more like a formality. However, They have funded the company operations with an initial capital of £2,532,097. Which is impressive for a start-up. The total debt they had was £1,305,906 which is due to be paid within one year according to their financial statement for 30th November 2022. All this aside, they have taken a giant leap forward after their first year of operations. They have increased their total current assets to £8,668,500 from £3,833,175 which is a 126% growth. If we look at the total net assets y-o-y which is a 78% growth. These figures are telling us they are in this game for the long run and are opting to build something amazing. We have to give them a 9/10 for their transparency. The only risk we could see at this point is the debt level which is about 50% of the total current assets (including the debt and amounts due within one year). Finally, we can conclude they have the financial strength to operate an actual prop firm that funds their traders.

Now that we have a solid understanding of who owns Funded Trading Plus (FTP) and their financial health we can move on to the analysis of their reviews.

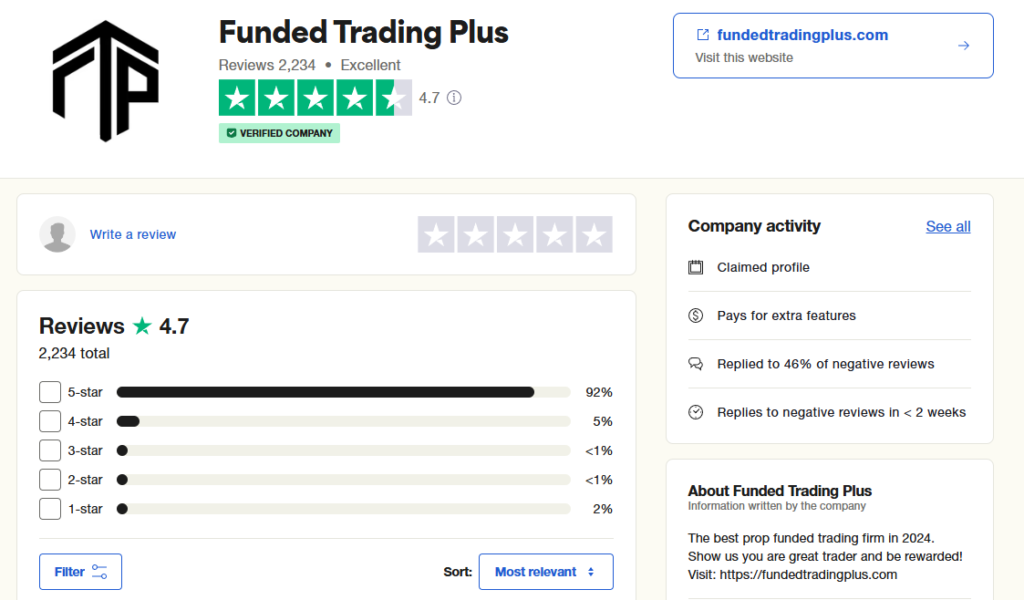

Trustpilot Reviews Analysis

Funded Trading Plus is a verified company in Trustpilot with a score of 4.7/5, one thing that we look at bro in finance when we review a company is the ratio of 5-star reviews to the collection of 3 stars and below reviews. If a company has more 3 stars and below than 5-star reviews then that’s the company you should avoid. But if you look closely they have about 60-67 reviews below 3 stars conversely they have about 97% of reviews above 4 stars. Furthermore, they have replied to 46% of the negative reviews within 2 weeks meaning they are keeping a good eye on the spammer which is good because competitors are always looking to capitalise on these minor details.

Based on these results, we are happy to award them a 9/10. We have deducted one point for not being able to review on Facebook.

Finally, Bro in Finance Recommends Funded Trading Plus (FTP) as the best CFD Prop firm with a Bro score of 9/10 based on analysis of ownership structure, financial stability and reviews. If you are looking to purchase your first prop firm package we will give you 15% off from the Static Drawdown Program.

FAQ

Is Funded Trading Plus a good prop firm?

Bro in Finance Recommends Funded Trading Plus (FTP) as the best CFD Prop firm with a Bro score of 9/10 based on analysis of ownership structure, financial stability and reviews.

What is the profit target for funded trading plus?

10% for the first phase and 5% for the second phase

Is funded trading worth it?

Yes, if you don’t have the capital to trade on your own, because to make a living out of trading you need to have a large enough capital to trade

Who is the CEO of Funded Trading Plus?

Director Of Operations: FRANGLETON, James Anthony

Managing Director: MASSEY, Simon Paul

For more US Finance News at Bro in Finance US Finance News

For more US AI Stock Analysis at Bro in Finance US AI Stock Analysis

For AI driven forex predictions at Bro in Finance

For Crypto News at Bro in Finance

For Economic Calendar for at Bro in Finance

Crypto, Simplified. Buy Now with Bro In Finance.

To Trade up to million dollars with Best Prop firms in the industry

If you are looking for a Best forex broker that Bro in Finance recommend AvaTrade

Check out Our Free ” How to” guides at Bro in Finance